只要幾分鐘的時間建立一個真實帳戶並開始交易

我們提供15個最具流動性和廣泛交易的商品市場,有無數的機會可以利用主要市場週期和季節性交易條件來獲利。

當你通過Moneta Markets 億滙交易商品時,你可以通過以實物資產定價的差價合約(CFDs)進入諸如石油,黃金,天然氣,咖啡,橙汁等市場!

今天就開始交易商品吧!

| 平臺符號 | 類型 | 市場 | 大小/體積 | 每跳動的美元價值 | 例如每跳動的價值 | 1%保證金 | 貨幣 | 最大槓桿 | 最小交易量 | 最大交易量 |

|---|---|---|---|---|---|---|---|---|---|---|

|

CL-OIL

|

CFD Oil |

Nymex/ CME |

0.01 = 10 barrels |

USD$0.10 |

99.56 → 99.57 |

1% x (10 x market price) |

USD |

333:1 |

0.01 |

20 |

|

NG

|

CFD Natural Gas |

Nymex/ CME |

0.01 = = 100 MMBtu |

USD$0.1 |

1.935 → 1.936 |

1% x (100 MMBtu x price per MMBtu) |

USD |

20:1 |

0.10 |

20 |

|

Gas

|

CFD Gasoline |

Nymex/ CME |

0.01 = = 420 Gallon |

USD$0.042 |

1.0158 → 1.0159 |

1% x (420 Gallon x price per gallon) |

USD |

20:1 |

0.01 |

20 |

|

GASOIL-C

|

CFD Gasoil |

Nymex/ CME |

0.01 = 10 Metric Tonnes |

USD$0.1 |

458.24 → 458.25 |

1% x (10 Metric Tonnes x price per metric tonnes) |

USD |

100:1 |

0.1 |

20 |

|

USOUSD

|

CFD Cash |

Market Cash |

0.01 = 10 Barrels |

USD$0.10 |

50.00 → 50.01 |

1% x (10 x Market price) |

USD |

333:1 |

0.01 |

20 |

|

UKOUSD

|

CFD Cash |

Market Cash |

1 |

USD$0.001 |

65.731 → 65.732 |

1% x (10 x Market price) |

USD |

333:1 |

0.01 |

20 |

| 平臺符號 | 類型 | 市場 | 大小/體積 | 每跳動的美元價值 | 例如每跳動的價值 | 1%保證金 | 貨幣 | 最大槓桿 | 最小交易量 | 最大交易量 |

|---|---|---|---|---|---|---|---|---|---|---|

|

Forex Gold |

FX Spot |

0.01 = 1 oz |

USD$0.01 |

1070.60-> 1070.61 |

1% x (100 oz x price per oz) |

USD |

1000:1 |

0.01 |

50 |

|

|

Forex Silver |

FX Spot |

0.01 = 50 oz |

USD$0.50 |

12.52-> 12.53 |

1% x (50 oz x price per oz) |

USD |

100:1 |

0.01 |

20 |

|

Forex Gold |

FX Spot |

0.01 = 1 oz |

USD$0.01 |

1070.60-> 1070.61 |

1% x (100 oz x price per oz) |

AUD |

1000:1 |

0.01 |

50 |

|

|

Forex Silver |

FX Spot |

0.01 = 50 oz |

USD$0.50 |

12.52-> 12.53 |

1% x (50 oz x price per oz) |

AUD |

100:1 |

0.01 |

20 |

|

|

Copper |

Nymex/ CME |

0.01 = 250 lbs |

USD$0.025 |

2.0655-> 2.0656 |

1% x (250 lbs x price per lbs) |

USD |

20:1 |

0.01 |

10 |

| 平臺符號 | 類型 | 市場 | 大小/體積 | 每跳動的美元價值 | 例如每跳動的價值 | 1%保證金 | 貨幣 | 最大槓桿 | 最小交易量 | 最大交易量 |

|---|---|---|---|---|---|---|---|---|---|---|

|

Cocoa-C

|

Soft Commodity |

Nymex/ CME |

0.1=1 Metric Tons |

USD$0.1 |

1928.5-> 11928.6 |

2% x (1 Tons x price per Ton) |

USD |

50:1 |

0.1 |

20 |

|

Coffee-C

|

Soft Commodity |

Nymex/ CME |

0.1=3,750 Pounds |

USD$0.375 |

1.3340-> 1.3341 |

2% x (3,750 Pound x price per Pound) |

USD |

50:1 |

0.1 |

20 |

Cotton-C

|

Soft Commodity |

Nymex/ CME |

0.1=5,000 Pounds |

USD$0.05 |

0.72152-> 0.72153 |

3% x (5,000 Pound x price per Pound) |

USD |

33:1 |

0.1 |

20 |

|

Orange-C

|

Soft Commodity |

Nymex/ CME |

0.1=1,500 Pounds |

USD$0.15 |

1.2977-> 1.2978 |

3% x (1,500 Pound x price per Pound) |

USD |

33:1 |

0.1 |

20 |

|

Sugar-C

|

Soft Commodity |

Nymex/ CME |

0.1=11,200 Pounds |

USD$1.12 |

0.1443-> 0.1444 |

3% x (11,200 Pound x price per Pound) |

USD |

33:1 |

0.1 |

20 |

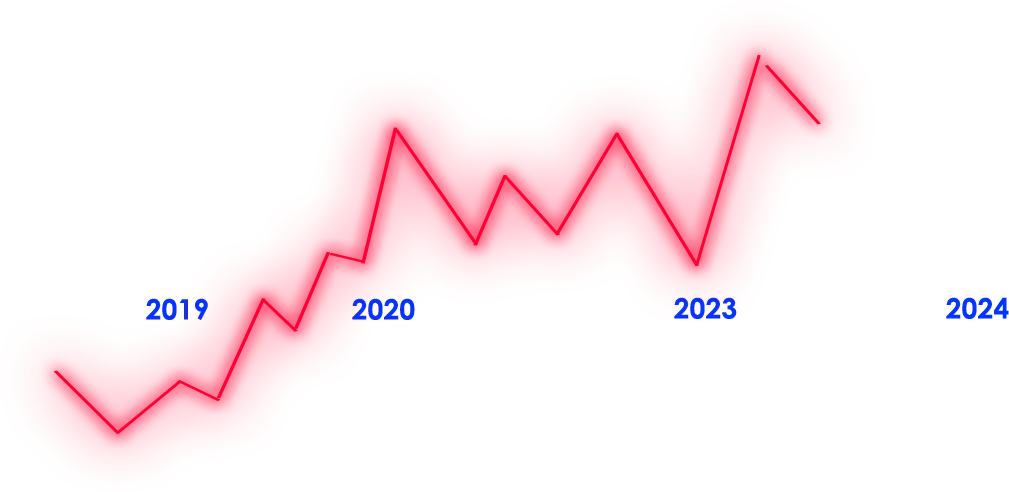

Gold

Gold breaks higher from its multi-year consolidation, triggering what could be the next year of a monster move

Covid

Global Conflict

After 2-3 years consolidation due to global conflict and covid lockdowns, gold breaks out to resume its move into blue skies

What’s next?

What will trigger the next major move?

Don’t miss the next bull or bear market!