Open a live account and start trading in just minutes.

This site uses cookies to provide you with a great user experience. By visiting monetamarkets.com, you accept our cookie policy.

Allow allThis site uses cookies to provide you with a great user experience. By visiting monetamarkets.com, you accept our cookie policy.

Allow allThis website is operated by Moneta Markets Ltd, which is not authorised or regulated by the UK Financial Conduct Authority (FCA) and does not offer or promote services to UK residents. Access to this website is restricted in the UK and the content is not intended for distribution to, or use by, any person located in the UK. If you believe you have reached this website in error, please exit the page now

Please note that Moneta Markets operates this website and its services are not directed at residents of your jurisdiction.

The information on this site is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

If you have arrived here in error, we kindly advise you to exit the site.

Continue to Site

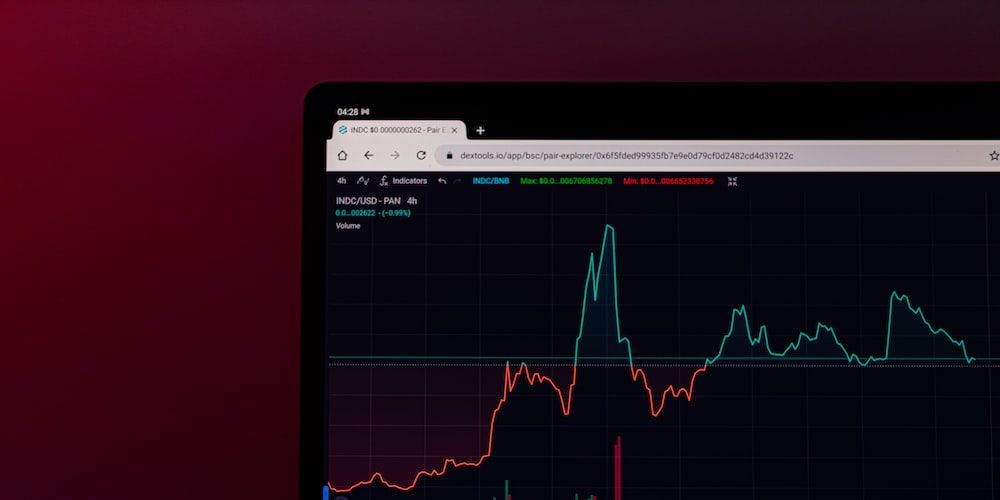

What is the Williams’ Percent Range indicator? The Williams’ Percent Range (W%R) is a technical analysis indicator that is used to identify overbought and oversold conditions in the market. It is calculated by comparing the current closing price to the …

What is the Variable Index Dynamic Average (VIDYA)? The Variable Index Dynamic Average (VIDYA) is a technical analysis indicator that combines elements of moving averages and the directional movement index (DMI) to provide a dynamic and adaptable view of market …

What is the Stochastic Oscillator? The Stochastic Oscillator is a technical analysis indicator that is used to determine overbought and oversold conditions in the market. It is based on the premise that prices tend to close near the high or …

What is the Standard Deviation indicator? The Standard Deviation indicator is a technical analysis tool that measures the volatility of a financial instrument, such as a stock or currency pair. It is a statistical measure that shows how much the …

What is the Relative Vigor Index (RVI)? The Relative Vigor Index (RVI) is a technical analysis tool that traders use to identify potential buying and selling opportunities based on changes in market momentum. The RVI is a variation of the …

What is the RSI indicator? The Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. It is a …

What is the Parabolic SAR indicator? The Parabolic Stop and Reverse (SAR) is a technical analysis indicator that is used to determine the direction and strength of a trend, as well as to signal potential trend reversals. The SAR is …

What is On Balance Volume? On Balance Volume (OBV) is a technical analysis indicator that uses volume data to evaluate the strength of a trend. It was developed by Joseph Granville, a well-known technical analyst and author of several books …

What is the Moving Average of Oscillator? The Moving Average of Oscillator (MAO) is a technical analysis tool that traders use to identify changes in market momentum and trend strength. It is a variation of the Moving Average Convergence Divergence …

What is the MACD indicator? The Moving Average Convergence Divergence (MACD) is a momentum indicator that shows the relationship between two moving averages of a security’s price. It is commonly used to identify trend changes and to confirm trends, as …

Open a live account and start trading in just minutes.

Fund your account using a wide range of funding methods.

Access 1000+ instruments across all asset classes