This site uses cookies to provide you with a great user experience. By visiting monetamarkets.com, you accept our cookie policy.

Allow allThis site uses cookies to provide you with a great user experience. By visiting monetamarkets.com, you accept our cookie policy.

Allow all

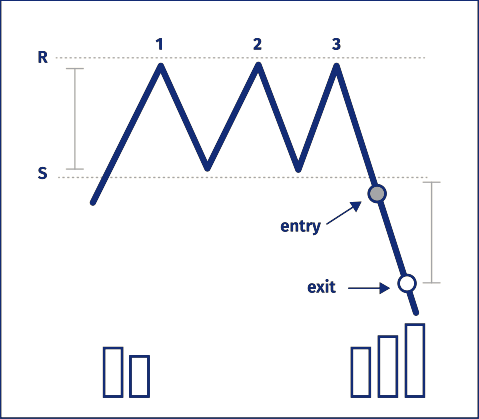

The triple top pattern is a bearish chart pattern that is formed by three distinct peaks, with the price rising to a resistance level and then falling back down each time. This pattern is created when the price of an asset rises to a resistance level, falls back down, and then rises again to the same resistance level two more times before eventually breaking through the support level and falling. The triple top pattern is a reversal pattern, which means that it is typically seen as a bearish sign and indicates that the asset’s price is likely to reverse its upward trend and start falling.

To form a triple top pattern, the asset’s price will typically rise to a resistance level, fall back down, and then rise again to the same resistance level two more times before breaking through the support level and falling. The pattern is typically completed when the price breaks through the support level, which is a trendline that connects the lows between the three peaks.

One of the key characteristics of the triple top pattern is that the trading volume tends to increase as the pattern progresses. This is because the price is making a significant move and there is more activity from traders. However, once the price does break through the support level, trading volume may decrease as the price starts to fall and traders become less active.

It is important to note that the triple top pattern is a bearish pattern, but it is not a guarantee that the asset’s price will fall. As with any trading strategy, it is important to use risk management techniques and to always be aware of the potential for losses.

One way to trade the triple top pattern is to set a sell order just below the support level, as this is where the price is likely to break through and start falling. Traders can also set a stop loss order just above the highest of the three peaks, in case the price does not break through the support and instead rises back up.

Another way to trade the triple top pattern is to wait for confirmation that the price has indeed broken through the support level before entering into a short position. This can be done by looking for additional bearish signals, such as a bearish crossover on a moving average or a bearish candlestick pattern.

It is important to keep in mind that the triple top pattern can take some time to form, as the price needs to rise to the resistance level, fall back down, and then rise again to the same resistance level two more times before breaking through the support level and falling. Traders should be patient and wait for the pattern to complete before entering into a trade.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Trading derivatives is risky. It isn't suitable for everyone; you could lose substantially more than your initial investment. You don't own or have rights to the underlying assets. Past performance is no indication of future performance and tax laws are subject to change. The information on this website is general in nature and doesn't consider your personal objectives, financial circumstances, or needs. Please read our legal documents and ensure that you fully understand the risks before you make any trading decisions.

The information on this site is not intended for residents of Canada, Cyprus, France, Spain, Russia, Ukraine, Italy, the United States, or use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

Moneta Markets is a trading name of Moneta Markets (Pty) Ltd, an authorised Financial Service Provider (“FSP”) registered and regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa under license number 47490 and located at 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa. Company Registration Number: 2016 / 063801 / 07. Contact Phone Number: +27 (10) 1429139. Operational Office: Unit 7, 31 First Avenue East, Parktown North, Gauteng, Johannesburg, 2193, South Africa.

Mmonexia Ltd, facilitates payment services to the licensed and regulated entities within the Moneta Markets Organizational structure.

Mmonexia Ltd registered in the Republic of Cyprus with registration number HE436544 and registered address at Archbishop Makarios III, 160, Floor 1, 3026, Limassol, Cyprus. Mmonexia Ltd, facilitates payment services to the licensed and regulated entities within the Moneta Markets Organizational structure.

Moneta Markets Limited. Business Registration Number:72493069. Registration Address: Flat/RM A 12/F ZJ 300, 300 Lockhart Road, Wan Chai, Hong Kong. Contact Phone Number: +852 37522556. Operational Office: Unit 1201, 12/F, FWD Financial Centre, 308 Des Voeux Road Central, Sheung Wan, Hong Kong.

Moneta Markets is a trading name of Moneta Markets (Pty) Ltd, an authorised Financial Service Provider (“FSP”) registered and regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa under license number 47490 and located at 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa. Company Registration Number: 2016 / 063801 / 07. Contact Phone Number: +27 (10) 1429139. Operational Office: 31 First Avenue East, Parktown North, Gauteng, Johannesburg, 2193, South Africa.

Moneta Markets is a trading name of Moneta Markets Ltd, registered under Saint Lucia Registry of International Business Companies with registration number 2023-00068.

Mmonexia Ltd registered in the Republic of Cyprus with registration number HE436544 and registered address at Archbishop Makarios III, 160, Floor 1, 3026, Limassol, Cyprus.

Moneta Markets PTY LTD soliciting Business from UAE through a Non-Exclusive Introducing Broker Agreement Regulated by SCA , Sterling Financial Services LLC ,Cat 5 ,No 305029

Moneta Markets is a trading name of Moneta Markets (Pty) Ltd, an authorised Financial Service Provider (“FSP”) registered and regulated by the Financial Sector Conduct Authority (“FSCA”) of South Africa under license number 47490 and located at 1 Hood Avenue, Rosebank, Johannesburg, Gauteng 2196, South Africa. Company Registration Number: 2016 / 063801 / 07. Contact Phone Number: +27 (10) 1429139. Operational Office: 31 First Avenue East, Parktown North, Gauteng, Johannesburg, 2193, South Africa.

Moneta Markets is a trading name of Moneta Markets Ltd, registered under Saint Lucia Registry of International Business Companies with registration number 2023-00068.

Mmonexia Ltd registered in the Republic of Cyprus with registration number HE436544 and registered address at Archbishop Makarios III, 160, Floor 1, 3026, Limassol, Cyprus.

Moneta Markets PTY LTD soliciting Business from UAE through a Non-Exclusive Introducing Broker Agreement Regulated by SCA , Sterling Financial Services LLC ,Cat 5 ,No 305029